AMD reports earnings; What’s on the cards? – Stock Market News

Advanced Micro Devices (AMD) will release its latest earnings on Tuesday, August 1, after Wall Street’s closing bell. Earnings are expected to have declined from last year, amid a sharp slowdown in gaming demand. Nonetheless, AMD shares have risen 76% so far this year, as investors are razer-focused on the company’s future prospects in the AI revolution.

AMD shares storm higher

It has been a magnificent year for AMD shareholders. With the hype surrounding artificial intelligence (AI) reaching fever pitch, investors have rushed to increase their exposure to AMD, as it is essentially the only chip designer that can currently compete with Nvidia in the AI wars.

Although AMD was late to join the AI party, it is trying to make a grand entrance. Last month, the company unveiled its MI300 chip, which has been touted as the world’s most advanced accelerator for generative AI. That means the chip is ideal for training large language models such as ChatGPT, which have burst into the scene lately.

Similarly, AMD has become a bigger player in cloud computing and data centers. While Nvidia currently dominates this market, AMD has been taking market share, and is releasing new variations of chips specialized for data centers. In fact, some recent reports suggest Amazon’s cloud unit is considering using AMD chips, which would be huge since Amazon is the world’s largest cloud provider.

Similarly, AMD has become a bigger player in cloud computing and data centers. While Nvidia currently dominates this market, AMD has been taking market share, and is releasing new variations of chips specialized for data centers. In fact, some recent reports suggest Amazon’s cloud unit is considering using AMD chips, which would be huge since Amazon is the world’s largest cloud provider.

Earnings decline

Even though AMD’s future seems bright, the present is challenging. Over the last year there has been a sharp slowdown in demand for gaming components, such as processors and graphics cards, which are still the company’s bread and butter.

As such, the upcoming results are expected to be ugly. For the second quarter of 2023, analysts expect revenue to have declined by 19% and earnings to have fallen by 45.5% compared to the same quarter last year.

Normally, these would be terrible results and a major source of concern for investors. However, most of this weakness is essentially a post-pandemic hangover as many clients over-ordered during the lockdown shortages, which essentially pulled demand forward. The company is now dealing with the aftershocks.

In general, investors are much more interested about any AI plans, viewing that as a much bigger market than gaming could ever be. The stock’s stellar performance this year suggests that as long as the AI dream is alive, traders are willing to overlook any short-term obstacles such as this one.

Therefore, the subsequent conference call with the company’s management might be even more important than the earnings numbers themselves. The guidance provided by CEO Lisa Su for the next quarters will likely overshadow everything else in terms of market impact.

Therefore, the subsequent conference call with the company’s management might be even more important than the earnings numbers themselves. The guidance provided by CEO Lisa Su for the next quarters will likely overshadow everything else in terms of market impact.

From a chart perspective, AMD shares have been in a clear uptrend since bottoming out in October, recording a series of higher highs and higher lows. The most important level to watch on the upside is the 121.5 zone, while on the downside, any declines below the 107 region could signal that the uptrend is unraveling.

Valuation is pricey

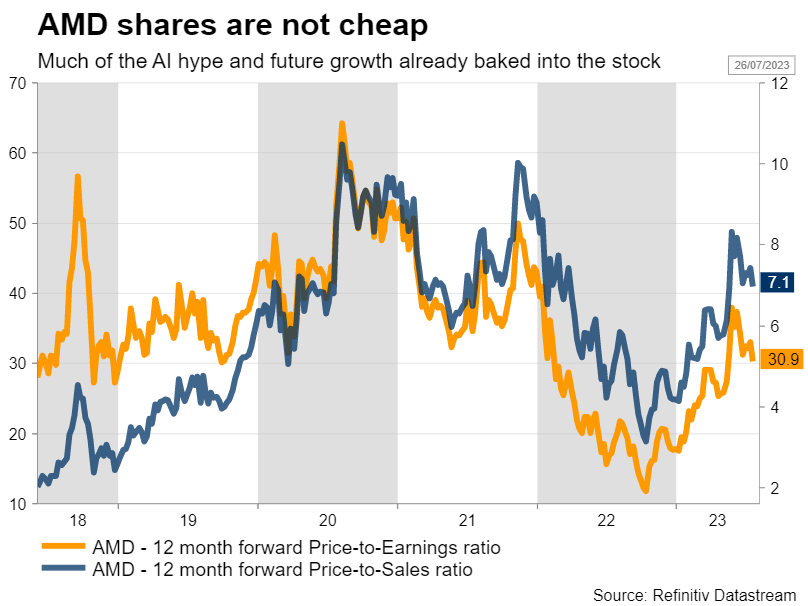

Turning to AMD’s valuation, the stock is not cheap. Shares are trading for 30 times what analysts expect earnings to be over the next year, which suggests that a lot of future growth is already baked into the cake.

This valuation has nearly tripled since October, as the share price rallied but earnings declined, making the stock increasingly more expensive. AMD shares have been even more expensive in recent years, but that was during a period of booming profit growth.

In other words, the shares already reflect investor expectations that the AI-driven growth will help AMD boost its profits in the future. Hence, for the share price to move even higher and aim for new record highs, the company will need to exceed these rosy expectations.

Overall, even though the stock’s valuation is pricey, AMD seems well positioned to grow over the coming years. It has managed to surpass Intel in processors and is rivaling Nvidia in graphics cards for gaming. If it manages to pull off a similar feat in the space of AI chips, that could be a game changer both for the company and the stock.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。