Are there more AI growth opportunities to be priced into the markets?

Nvidia skyrockets and drives the S&P 500 to new records

Demand for chips continues to surge, AI enters consumers’ life

There maybe more AI growth opportunities to be priced in

But downside risks on high valuations and geopolitics do exist

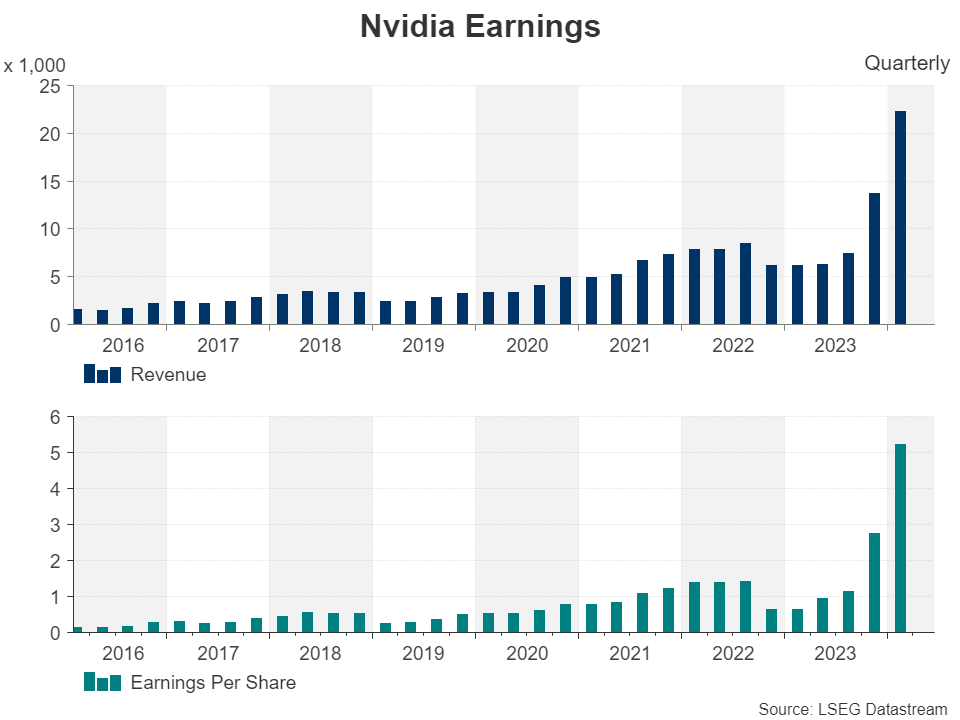

Just last week, the investor favorite Nvidia beat out Amazon and Alphabet to take the third place as the most valuable company in the US by market capitalization, and although the chipmaker’s stock pulled back before its earnings announcement, it rebounded to new record highs after the firm reported results better than Wall Street’s already ultra-optimistic forecasts.

This has propelled Wall Street higher, with the S&P 500 also entering uncharted territory and a question dominating almost all investors’ minds: How much longer can the artificial intelligence (AI) euphoria last? In other words, is the AI rally at its final stages or is there more fuel in the tank?

There is no simple and easy answer of course. On the one hand, there are those who believe that the turning point is near as the AI hype has already surpassed the 90s dot-com bubble as the top companies in the S&P 500 today are more overvalued than the top firms then. On the other hand, there are those saying that the earnings performance is suggesting that Wall Street is not in trouble, at least not yet.

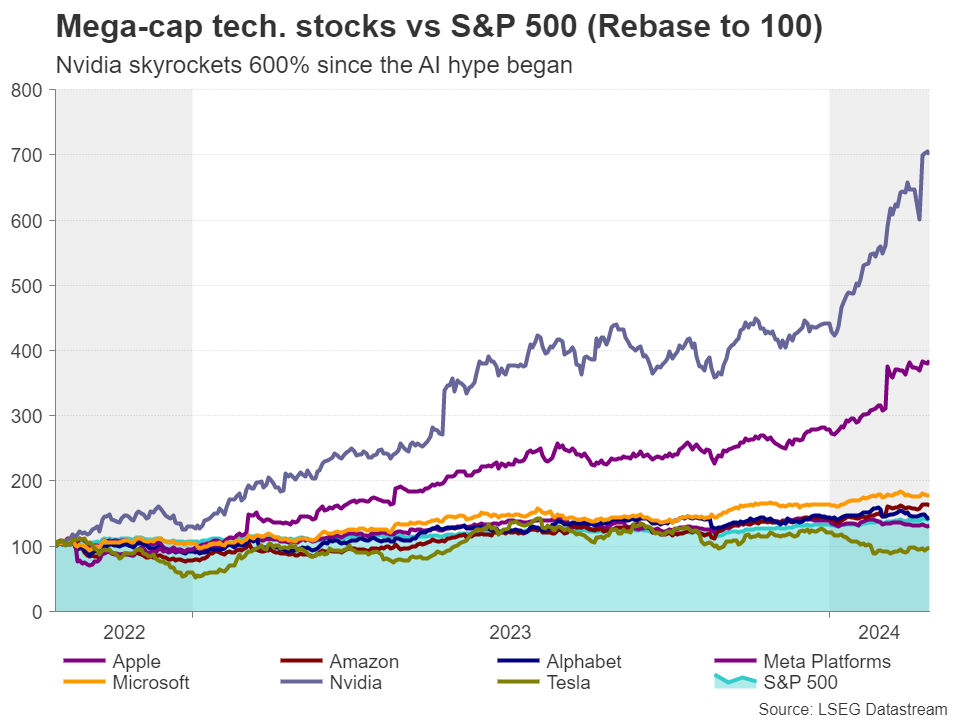

Demand for chips is surging worldwideThe euphoria around AI began in late 2022 after the release of ChatGPT 3.0, which opened the Pandora box regarding the possibilities of generative AI. Computer chips are the cornerstone component of generative AI systems, which require a lot of data processing and thus, with Nvidia being the dominant player – owning around 80% of market share – in AI chips, it’s shares have skyrocketed around 600% since the October 2022 lows, driving the S&P 500 up around 45%.

Demand for chips is surging across the globe, Nvidia’s CEO noted after the firm announced results for the last quarter of 2023, adding that they expect it to continue to be stronger than their supply. It is worth mentioning that earlier this month, Meta Platforms announced that they are planning to purchase more than $9bn worth of Nvidia graphic cards.

AI consumer-based products and roboticsWhat’s more, beyond the business-to-business part of chip making, the product has well reached consumers. Apart from the subscriptions to web-based and app-based chatbots, tech-giants have already begun introducing AI Phones, AI TVs, and AI PCs, all equipped with chips that are responsible for executing each product’s AI functionalities.

Robotics is also entering the discussion. Yes, creating larger robots is more expensive to develop than just chips for running software on computers, but the race is already on. Introducing robotics in large organizations is very likely to result in cost-savings, while also boosting productivity and thereby profitability.

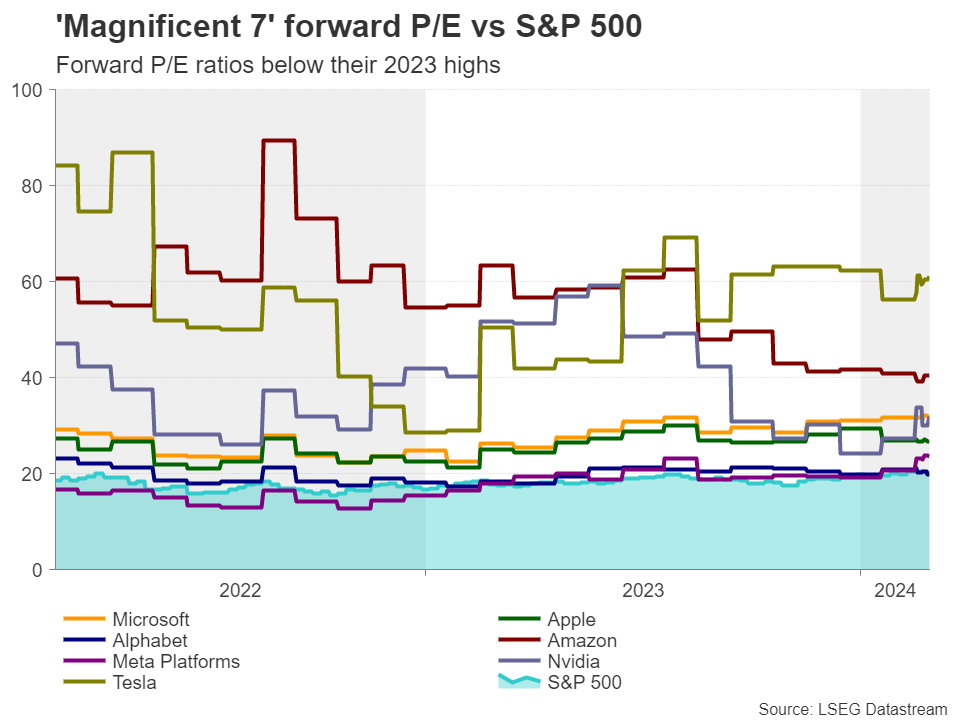

Could high valuations go even higher?Since the world might only just be starting to get a taste of how AI can impact our lives, are all the future growth opportunities of tech-firms already priced in or is there more? From a multiples’ perspective, although the forward price-to-earnings (P/E) ratios of almost all the ‘Magnificent 7’ tech giants are higher than the forward P/E ratio of the S&P 500, they are below their 2023 highs.

Nvidia is trading around 40 times the estimated earnings for next year, nearly double the 20.3x ratio of the S&P 500, but well below its own peak of 62.45x hit in 2023. This combined with the firm’s projections of growing cash flows for the quarters and years ahead suggests that Nvidia’s stock could continue to conquer new highs for a while longer, despite being by far the main gainer in the S&P 500.

The downside risksNonetheless, this doesn’t mean that there are no downside risks to this view. The vertical rally in Nvidia suggests that even a temporary let-up in investor demand for the stock could result in a sharp decline. For example, any tensions between China and Taiwan could trigger worries. China is not recognizing Taiwan as a sovereign state, while for the construction of their chips, most chipmakers rely on one company in Taiwan called TSMC (Taiwan Semiconductor Manufacturing Company).

Having said that though, even if chipmakers come under selling interest at some point soon, any declines could still be considered as a corrective phase rather than the beginning of a full-scale bear market. AI investors may abandon chipmakers like Nvidia, but they may decide to increase their exposure to more established tech stocks, like Alphabet, Amazon, Apple, Meta, and Microsoft, which are also expanding their business in the AI field.

Will a cheap Alphabet attract diverting flows?The best candidate for diverting flows may be Alphabet. Google’s parent seems to be the only ‘Magnificent 7’ stock that is cheaper than the S&P 500, while in terms of performance, it has not deviated much from the index, which means that it’s not stretched more than the broader market is.

Although Alphabet’s stock declined this week after the criticism of its “Gemini” AI system, it seems to be among the companies holding a massive opportunity in AI. What’s more, its free cash flows are expected to decline somewhat in the coming quarters of 2024, but to rebound in 2025, which could keep it attractive in the eyes of long-term investors.

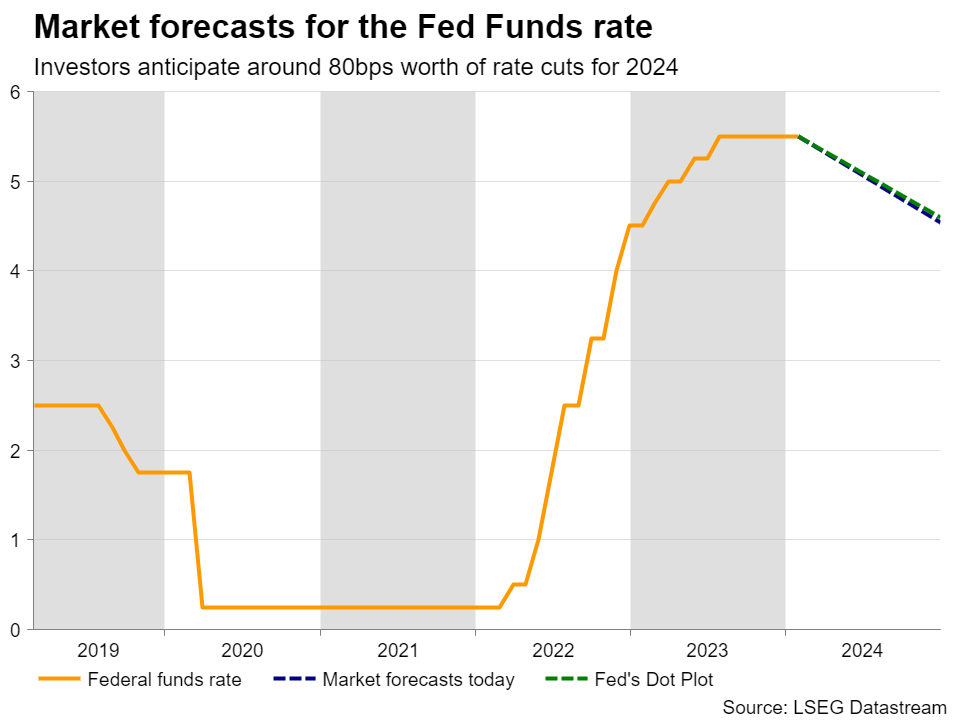

Fed rate cut expectations still a supportive variableAnother factor keeping high-growth tech firms attractive to investors may be expectations that the Fed will start lower interest rates at some point later this year.

The market has indeed priced out a significant amount of basis points worth of reductions since the start of the year but given that equity traders are mostly long-term investors, they may not be so concerned if rate cuts are delayed by a few months, especially if this is mainly due to a better-than-expected economic performance. The fact that no additional hikes are not on the table may be more than enough for them.

They may only decide to flee out of the stock market if expectations of delayed rate cuts are accompanied by disappointing growth estimates by big tech firms at the upcoming earnings seasons.免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。