Artificial Intelligence: Is the ‘baby bubble’ ready to pop?

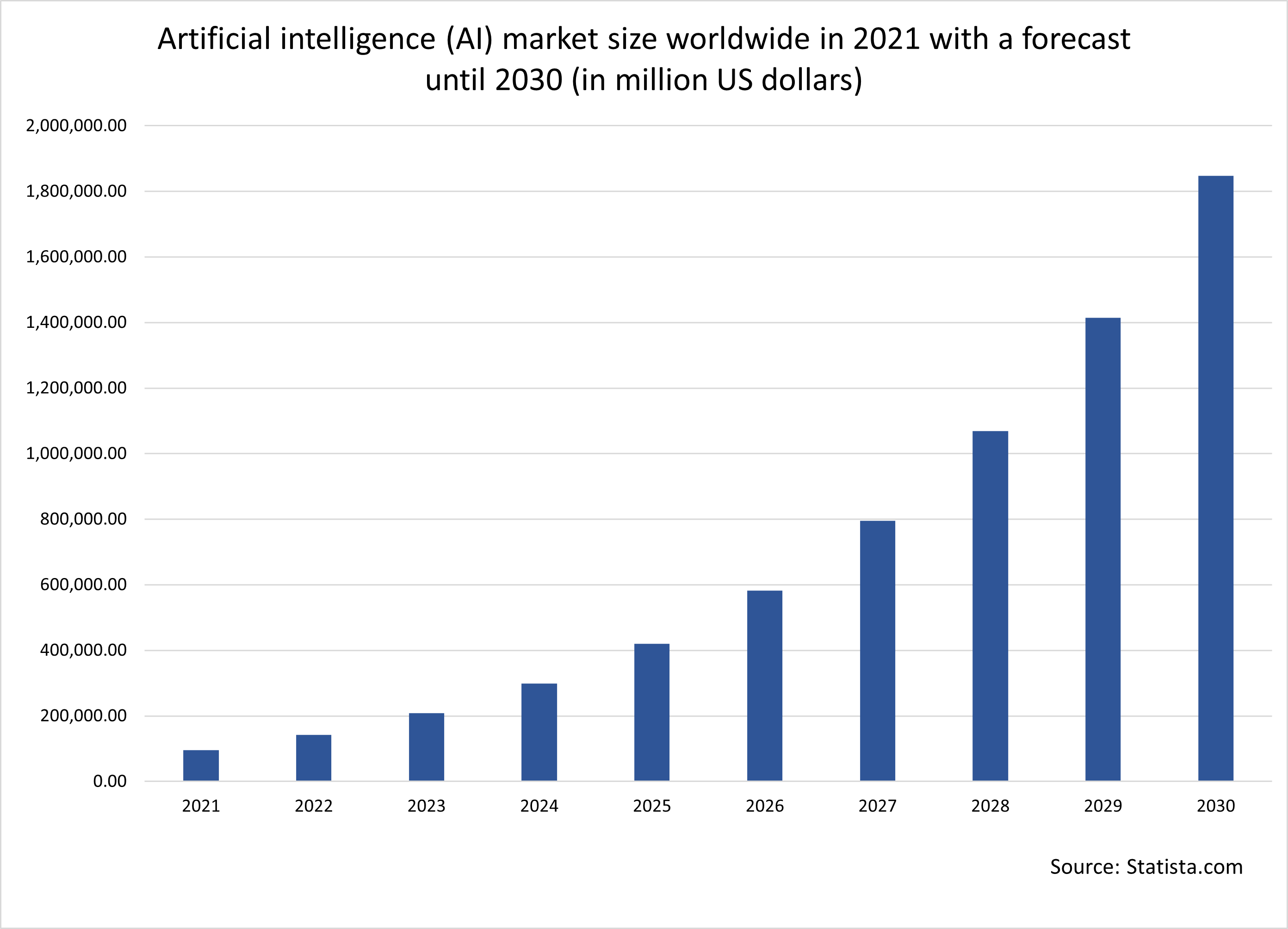

According to Statista, the AI market is expected to experience massive growth in the coming years, with its value of $100bn dollars in 2021 seen growing twentyfold by 2030, to around two trillion dollars. And what may have prompted many participants to jump into the AI bandwagon may have been the release of ChatGPT 3.0 in 2022, which opened the pandora box regarding the possibilities of generative AI.

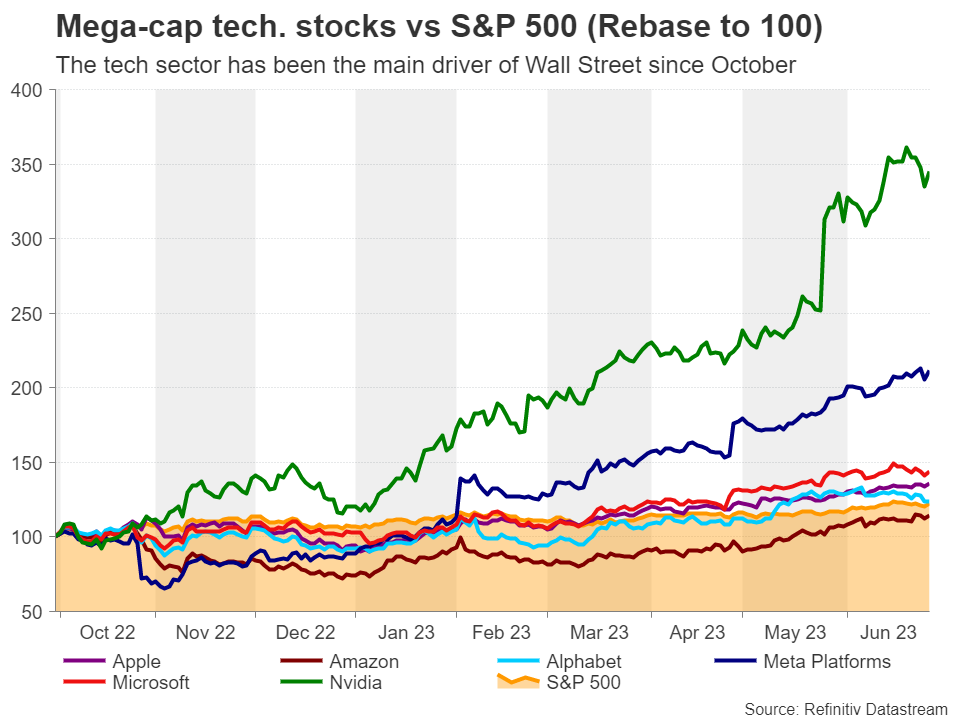

One way to bet on AI may be through chipmakers, as AI requires massive computer power and strong computing power means powerful microchips. The fact that Nvidia’s stock has surged more than 300% since its October lows is not an accident as this firm’s chips are the brains behind most of the AI chatbots we know, while the firm holds around 95% of the market share of machine learning chips. Other chipmakers, like AMD (Advanced Micro Devices) and Intel, also enjoyed massive gains, with the former surging by more than 100% since October and the latter around 50%.

But valuations suggest they are very expensiveSo, the bubble question is popping up on everyone’s mind and rightfully so. Looking at valuations, Nvidia is trading around 45 times the estimated earnings for next year, while just two weeks ago, that forward price-to-earnings (PE) ratio was almost at 60x. That’s well above the forward PE ratio of the S&P 500, which is at around 19x. So, the AI market can be considered overvalued and such numbers may discourage new investors from joining the action. Maybe that’s why there was a pullback in the stock market recently.

Geopolitics also constitute a risk

Geopolitics also constitute a riskOne other risk to the AI euphoria is geopolitics. For the construction of their chips, most chipmakers are reliant on one company in Taiwan, called TSMC (Taiwan Semiconductor Manufacturing Company). Thus, with China not recognizing Taiwan as a sovereign state, any tensions between the two countries could well affect the semiconductor market and thereby weigh on the AI bull market. Yes, due to those geopolitical risks, TSMC is trying to expand and diversify its business in other countries, including the US, but that’s not a plan that can be completed overnight.

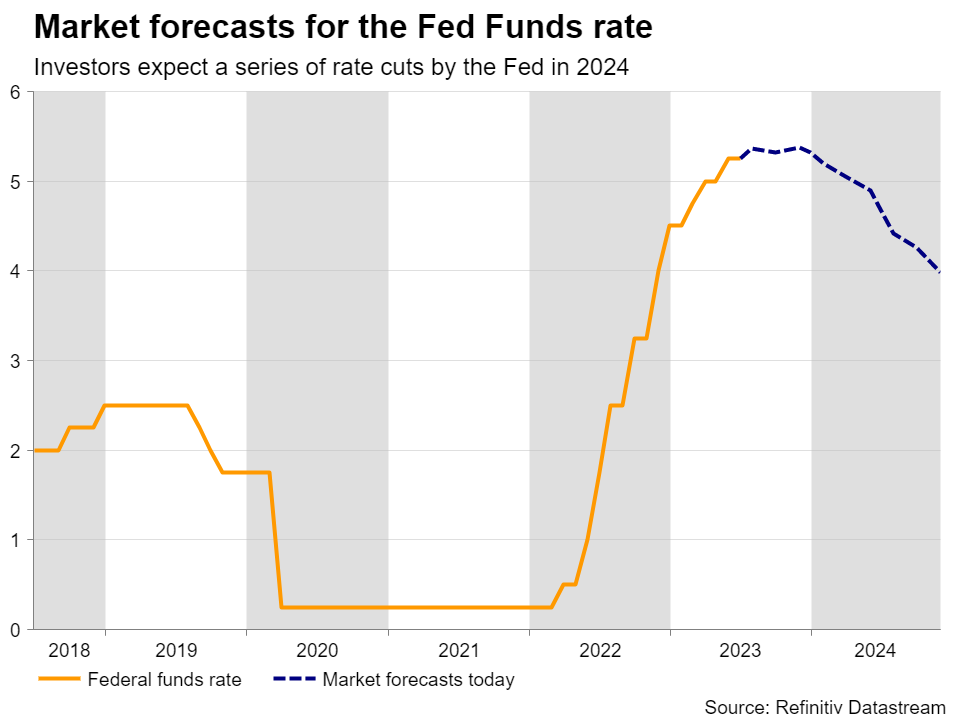

Expectations of growth and Fed cuts may keep losses limitedHaving said that though, even if there is a further pullback in the stock market, it could still be considered as a corrective phase rather than the beginning of a full-scale bear market. After all, most high-growth tech firms are valued by discounting expected cash flows for the quarters and years ahead. So, with Nvidia’s and other chipmakers’ cash-flow-per-share expected to continue accelerating in the foreseeable future, and also bearing in mind market expectations of several rate cuts by the Fed next year, present values have the potential to continue rising.

Even if geopolitical tensions rise and leave their mark, a potential episode of market risk-aversion could prompt AI investors to increase their exposure to mega-cap, more established, tech stocks, like Alphabet, Amazon, Apple, Meta, and Microsoft, which are also expanding their business in the AI field. Along with Nvidia, these giants are responsible for most of the gains in the S&P 500 since October.

For investors to start fleeing out of the stock market, not only does the Fed have to convince them that there are no rate cuts on the table for next year, but growth estimates for big tech firms in the upcoming earnings seasons may need to start disappointing. The Fed has already signaled that two more quarter-point hikes are on the table before it ends this tightening crusade and Fed Chair Powell said that rate reductions are ‘a couple of years out’. And yet, the market is penciling in only around 35bps worth of additional hikes, and several reductions in 2024. So, until the Fed or the data convince them to scale back those cut bets, investors may see the current retreat, or any near-term extensions of it, as an opportunity to buy at more attractive levels.

For investors to start fleeing out of the stock market, not only does the Fed have to convince them that there are no rate cuts on the table for next year, but growth estimates for big tech firms in the upcoming earnings seasons may need to start disappointing. The Fed has already signaled that two more quarter-point hikes are on the table before it ends this tightening crusade and Fed Chair Powell said that rate reductions are ‘a couple of years out’. And yet, the market is penciling in only around 35bps worth of additional hikes, and several reductions in 2024. So, until the Fed or the data convince them to scale back those cut bets, investors may see the current retreat, or any near-term extensions of it, as an opportunity to buy at more attractive levels.免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。