Banks Q1 earnings: Weak results despite stock outperformance – Stock Markets

US banks kick off Q1 earnings on Friday before opening bell

Earnings set to drop despite the robust US economy

Valuation multiples rise but remain historically cheap

Solid quarter due to Fed repricing

The banking sector started the year on the wrong foot as expectations of six rate cuts by the Fed had delivered a strong hit to their net interest margin outlook. This metric is essentially the difference between the interest income generated by long-term assets such as loans and the interest expense paid to short-term liabilities such as deposits.

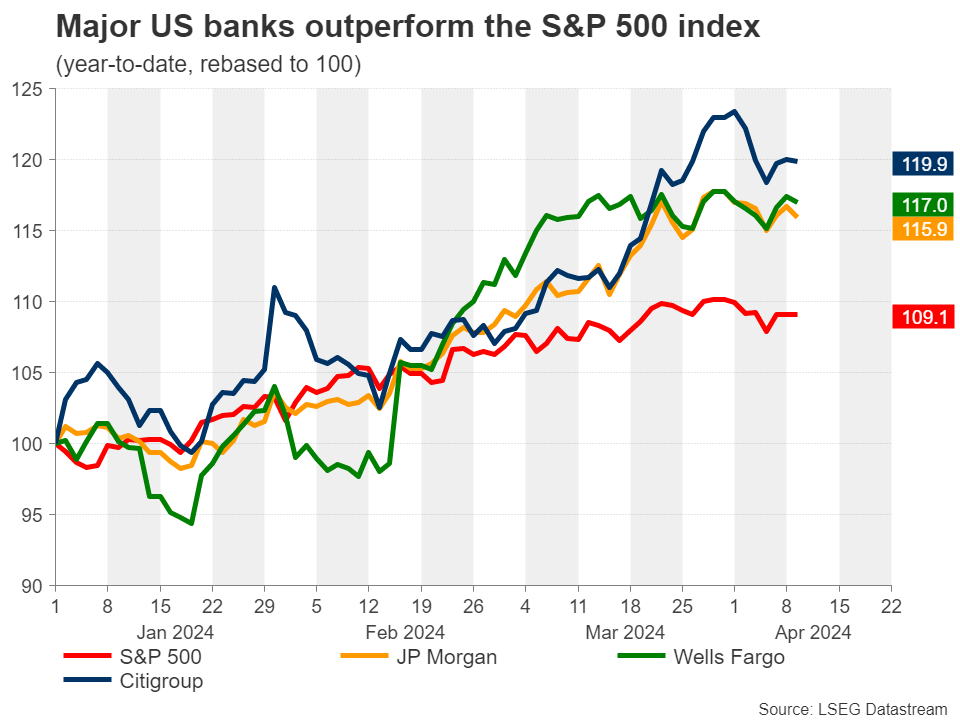

However, a barrage of upbeat macro US data prompted markets to dial back interest rate cut projections, with current market pricing implying a little less than three rate cuts in 2024. In turn, investors became more confident that the banks could preserve their wide net interest margins, which led to their stocks outperforming the S&P 500 index in 2024.

Focus on interest rates and economy

Moving forward, the interest rate trajectory as well as the health of the US economy will play a huge role on banks’ performance. For now, a strong economy has kept loan growth at considerable levels, while preventing a rise in non-performing loans.

Nevertheless, the repricing around Fed expectations has raised concerns for banks. Financial institutions are currently sitting on a pile of unrealised losses in their bond portfolios, and a forced liquidation in case of an exogenous event or a systemic crisis could result in enormous losses. Moreover, high interest rates continue to restrict dealmaking activity and put stress on risk-sensitive sectors such as real estate, in which investment banks have significant exposure.

But in any case, annual comparisons on net interest margin figures are going to be tough from now given that the Fed is on track to begin its rate cutting cycle sooner or later. Therefore, banks would like to see this weakness being offset by a rebound in M&A and dealmaking activities.

JP Morgan retains crown

JP Morgan was the best performing bank in 2023, recording the biggest annual profit in US banking history. Despite its relative outperformance against the other two examined financial institutions, JP Morgan is expected to show some signs of weakness in this earnings season.

Specifically, earnings per share (EPS) of the banking behemoth are estimated to have taken a hit for a second successive quarter, dropping 3.91% from a year ago to $4.15, according to consensus estimates by LSEG IBES. However, the bank is anticipated to record revenue of $41.83 billion, which would represent a year-on-year increase of 6.36%.

Wells Fargo set for a bad quarter

For Wells Fargo, the fundamental picture does not look that great. The bank is set to experience a deterioration in both its revenue and EPS figures, mainly driven by a narrowing net interest margin.

The bank is on track for a 2.54% annual decline in its revenue, which could reach $20.20 billion. Meanwhile, EPS is forecast to fall from $1.23 in the same quarter last year to $1.09, marking an 11.48% drop.

Citigroup’s major restructuring yet to provide results

Citigroup will face another tough earnings season despite its stock outperformance since the beginning of the year. The main reason behind this weakness is that its costly restructuring has not come to fruition yet.

The major investment bank is set to post an annual revenue drop of 4.92% to $20.39 billion. Moreover, its EPS is projected at $1.20, a whopping 35.50% decrease relative to the same quarter last year.

Discount in valuations persists

Although bank stocks have rallied hard since the beginning of the year, their valuations remain relatively subdued. Banks have not yet reached their pre-pandemic multiples even in a period of elevated interest rates, which is considered beneficial for financial institutions. At the same time, the S&P 500 is trading at 21 times forward earnings, way above its historical averages.

That said, the risks seem asymmetric at current levels as there might not be much downside even if we get a major negative surprise in upcoming earnings reports, considering how cheap valuations are.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。