Daily Market Comment – Dollar and stocks struggle amid anxious calm before the storm

- Tech earnings and US data awaited for direction as outlook remains clouded

- Lingering uncertainties drag US yields and the dollar lower; debt ceiling in focus

- Yen firms slightly after Ueda opens the door to future policy tightening

Markets turn tense in wait-and-see mode

Markets turn tense in wait-and-see modeStocks slid on Tuesday while the US dollar crawled above fresh lows as investor anxiety was running high following a tense session on Monday amid a number of uncertainties weighing on the markets. Investors remain none the wiser about the likelihood of a US recession even as the most recent PMI indicators pointed to ongoing resilience. The renewed jitters about a possible downturn in America and elsewhere came about after bailed-out First Republic Bank posted a bigger-than-expected outflow of deposits, spooking the markets.

Wall Street’s major lenders may have emerged unscathed from the banking stress but this earnings season is also laying bare the full scale of the damage incurred by their smaller regional rivals. Whilst that doesn’t mean that other banks are about to collapse, investors are being reminded that the spillover effect is probably not over and that credit conditions may continue to tighten for months to come.

Debt ceiling standoff adds to mounting headachesWith the week getting off to such a slow start, traders are starting to feel the heat from all the existing uncertainties that are no closer to being resolved. Aside from the banking troubles in the US, concerns about sticky inflation and what that means for the monetary policy outlook have also been on investors’ minds, not to mention doubts about the strength of China’s recovery.

If that wasn’t enough, the US debt ceiling is back in the headlines as the White House and the Republican-controlled House of Representatives are in a predictable standoff over raising the borrowing limit. House Speaker Kevin McCarthy is pushing for a vote this week on a bill that would slash spending by $4.5 trillion but increase the debt ceiling by just $1.5 trillion.

The Senate, where the Democrats have a majority, is unlikely to approve such a plan and fears of a debt default are rising as the US government could run out of cash as early as June due to lower-than-expected tax revenues.

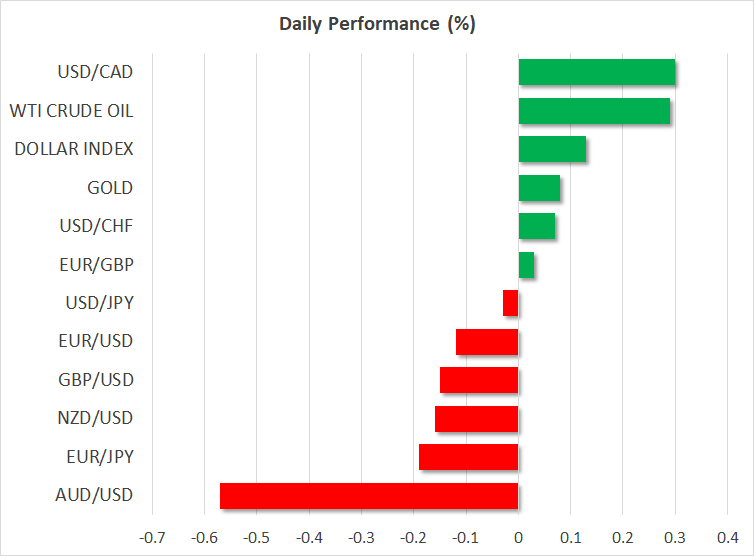

Dollar off lows as euro stumbles, yen mixedFed fund futures responded to the heightened nerves by pricing in somewhat higher odds of a rate cut by December, though for the May FOMC meeting next week, a 25-bps hike is a near certainty. Bond markets also attracted attention as traders sought safety in the midst of all the worries, pushing yields lower.

The 10-year Treasury yield just hit a 10-day low of 3.4430% and the two-year yield was down too. But the US dollar managed to find some footing to climb off its earlier session lows against a basket of currencies. US GDP and PCE inflation data due later in the week might inject some life into the greenback. In the meantime, the April consumer confidence index will be watched today.

The euro was holding above the $1.10 level after yesterday’s impressive rise. However, it may struggle to advance much further before the ECB meeting on May 4 as there’s some mixed messages again coming from policymakers. While some officials like Schnabel are sounding extremely hawkish, others such as France’s Villeroy see the tightening cycle coming to an end soon.

The yen was flat against the dollar on Tuesday and has been stuck around the 134 level since Friday. Newly appointed Bank of Japan governor Kazuo Ueda maintained the need for ultra-easy policy when speaking before parliament today. However, he didn’t shy away from raising the prospect that interest rates might have to go up should wage growth and inflation accelerate by more than anticipated.

Unlike his predecessor, Ueda doesn’t seem to be afraid to discuss monetary tightening and this is helping the yen to recoup some losses against the euro and pound today after hitting fresh lows.

Equities slip in wait for big tech earningsOn Wall Street, e-mini futures have started the day in the red, following the trend in Europe and Asia, after another subdued session on Monday. The S&P 500 and Dow Jones closed marginally higher but the Nasdaq fell 0.3% as some tech stocks came under pressure ahead of key earnings this week. Microsoft and Google parent Alphabet will report their results later today, along with Visa and General Electric.

Although the majority of companies that have reported so far have exceeded their earnings estimates, many stocks, particularly tech ones, have already rallied significantly this year so a lot is riding on not just the size of the beat but also on how positive or negative their guidance about the rest of the year will be.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。