Daily Market Comment – Dollar steady, stocks mixed ahead of US inflation data

- Dollar drifts sideways in choppy trading as investors brace for jump in US inflation

- Stocks lack direction as yields firm, US data, earnings awaited

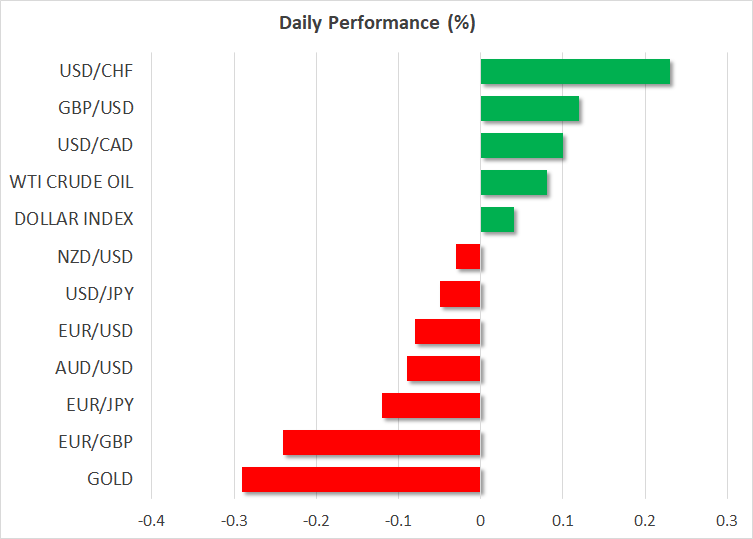

- Pound extends gains but most majors stuck in tight ranges, gold slides again

All eyes on US inflation

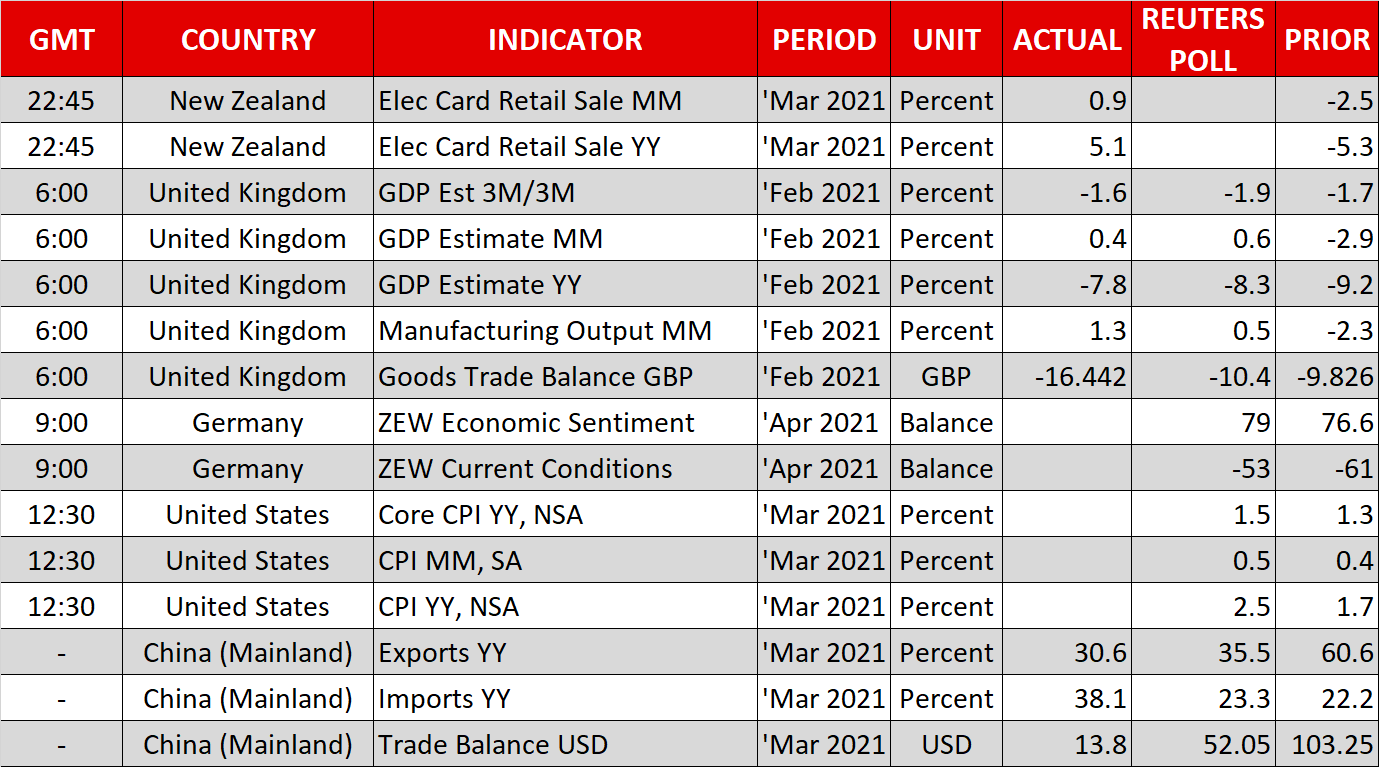

All eyes on US inflationWith yesterday’s $96 billion Treasury auction passing uneventfully, investors have turned their attention to the latest reading of the consumer price index out of the United States later today. Expectations of a spike in US inflation have been running high for some time now and markets are likely to get the first taste of actual inflation shooting above the Fed’s 2% target at 13:30 GMT.

After plunging to almost zero per cent during the pandemic, America’s headline inflation rate is projected to have surged to a more than one-year high of 2.5% y/y in March. Supply-chain disruptions, soaring energy prices and pent-up demand, not to mention last year’s low base effect, are all anticipated to push up consumer prices over the next few months.

However, inflation expectations have stabilized lately as the Fed appears to have calmed market fears of inflation spiralling out of control even as policymakers hint at being perfectly comfortable to fall behind the curve. The Fed has been unified in its message that it believes any big overshoot of inflation will be temporary and that its main priority right now is achieving maximum employment.

Nonetheless, markets are likely to be sensitive to a bigger-than-expected jump in CPI, especially if strong inflation numbers are followed up by robust retail sales figures on Thursday, which would heighten concerns about an overheating US economy.

Dollar marginally higher on firmer yieldsBut there was some relief ahead of the key data releases as Monday’s auctions of US government bonds – part of a $370 billion Treasury sale over three weeks – was met with sufficient demand. There will be more auctions today, for 30-year notes, but while the yield on those was steady, the 10-year yield was edging higher, giving the dollar a nudge up.

The greenback has been see-sawing in recent sessions, with the dollar index forming a strong support region just above 92.0. The index’s trend has been defined by euro/dollar’s tight range in recent days and the upcoming data could be what triggers a breakout in either direction for the pair.

The euro’s unusual resistance against the US dollar is being driven by some doubts about the ECB’s commitment to keeping Eurozone yields low as well as signs that the EU’s troubled vaccination campaign is finally gathering speed.

Subdued moves in FX and commodity spheresThe UK’s vaccination programme on the other hand has suffered a setback due to its over-reliance on the AstraZeneca jab, which has been mired in safety concerns, and this has been quite a drag on the pound. However, it’s been a positive start to the week so far for sterling as non-essential businesses in England and Wales have been allowed to reopen their doors as of Monday. In addition, the monthly GDP print released today showed the UK economy grew slightly in February, while January’s contraction was milder than initially estimated.

The Australian dollar continued to struggle despite upbeat trade figures out of China today. Soaring Chinese demand for imports was unable to lift the aussie but did buoy oil prices. The kiwi was up slightly ahead of the RBNZ policy decision early on Wednesday. Gold, meanwhile, remained on the backfoot, as it headed for a third-straight day of losses, brushing one-week lows. The precious metal could get a boost if US inflation beats expectations but even that may not be enough to counter the negative pressure from a possible subsequent surge in Treasury yields.

Stocks look to US earnings for directionThe mixed mood was also evident in equity markets where on top of the inflation angst, the start of the Q1 earnings season is also making some traders nervous. The S&P 500 held near record highs on Monday, but e-mini futures indicated another lacklustre session for Wall Street today.

That could easily change in the coming hours, though, if the US data sparks volatility in bond markets and as the earnings results start to come in. JP Morgan, Goldman Sachs and Wells Fargo will kick off the season tomorrow as investors eye a further recovery in bank earnings.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。