Daily Market Comment – Dollar succumbs to Powell’s dovish tune; stocks mixed

- Powell reiterates that rate hikes are a long way off, pressing down on yields

- Dollar skids again but upside risk from retail sales and jobless claims

- Banks kick off US earnings with a bang but only Dow Jones rises

Most dovish Fed Chair ever strikes again

Most dovish Fed Chair ever strikes againThe US dollar slid and the 10-year Treasury yield held near three-week lows as Fed Chair Jerome Powell went out of his way to dampen fears of pre-emptive action to stem rising inflation. Speaking on Wednesday to the Economic Club of Washington, Powell reiterated that the Fed would only begin winding down its asset purchases when it’s made substantial progress towards its goals. But crucially, Powell signalled that tapering would happen “well before” they start considering raising interest rates.

Treasury yields edged lower after Powell’s remarks, with the 10-yield falling towards 1.61%. Markets have finally started to take note of the Fed’s repeated assurances that creeping inflation won’t derail its current policy path even as the US consumer price index soars past 2%.

With growth accelerating amid a deluge of fiscal stimulus, a rapid vaccine rollout and falling virus cases, the Fed’s own agents are reporting stronger hiring and upward pressure on prices according to the April Beige Book.

The fast-improving economic backdrop is limiting how far Treasury yields can pull back. But the ongoing risks to the positive outlook are also supporting safe-haven bonds as the setbacks with the AstraZeneca and Johnson & Johnson vaccines have shown that there’s still plenty that can go wrong, especially if a new vaccine-resistant strain of Covid-19 emerges.

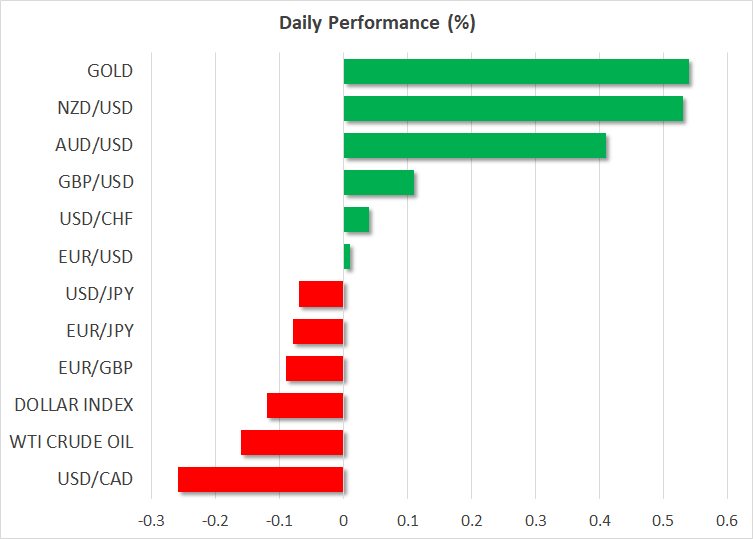

Dollar sags, aussie lifted by robust jobs dataBut for now, investors took comfort in Powell’s ultra-dovish stance, which weighed heavily on the greenback. The dollar index plumbed a fresh four-week low today, lifting its rivals. The improved risk tone further dented demand for the dollar, as well as for the yen, though some of the overnight moves had started to reverse by the European open.

The euro and pound both turned flat, easing slightly from one-month and one-week highs, respectively, against the dollar. Dovish comments by ECB President Christine Lagarde yesterday may be curbing the euro’s advances while rising political risks in the UK could be clipping the pound’s wings.

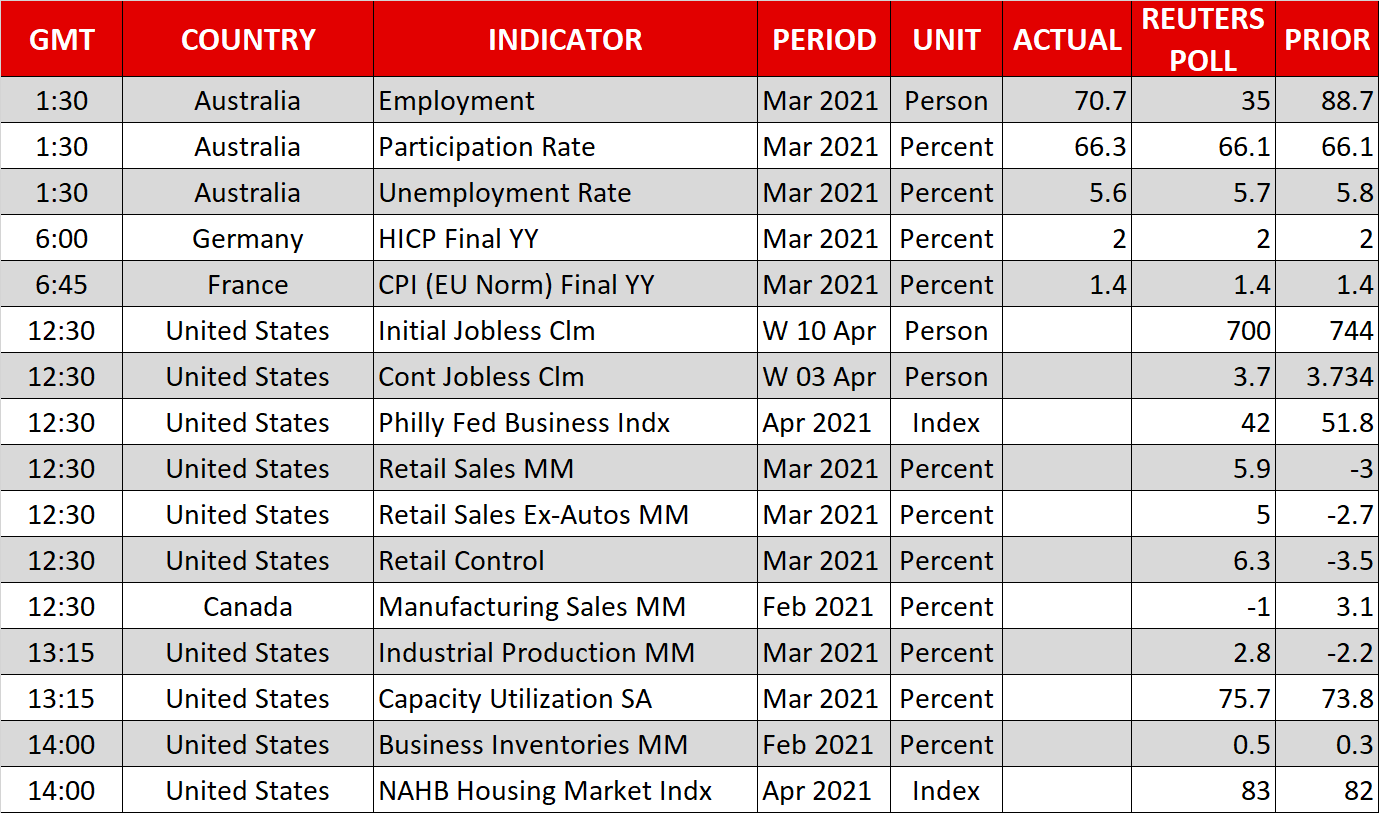

However, the Australian and New Zealand dollars extended their gains today to jump a further 0.5%, outperforming their peers. The aussie was additionally boosted by robust jobs numbers, which showed employment in Australia surpassed pre-pandemic levels in March.

The US labour market will come in focus later today when the latest initial jobless claims figures are published. Retail sales data will also be eyed as Americans likely upped their consumption in March. Stronger-than-expected numbers might help the dollar stabilize even if they’re not able to reverse the latest declines.

Gold rose disproportionately to the weakness in the dollar and yields, indicating perhaps some safety flows from growing tensions between Moscow and Washington as the Biden administration prepares to impose yet more sanctions on Russia.

US stock futures up ahead of more key earningsIn equity markets, the S&P 500 slipped back from fresh record highs to close 0.4% lower on Wednesday. Stellar earnings from Wall Street’s big banks were unable to offset a bit of a selloff in tech stocks, which pulled the Nasdaq Composite down 1%. Only the Dow Jones was able to finish the day in positive territory, but futures were pointing to a stronger open for all three indices on Thursday.

Bank earnings will continue today with Bank of America and Citigroup reporting before the market open. Delta Air Lines will also be under the spotlight for clues on how well the airline and travel industries are weathering the pandemic storm.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。