Daily Market Comment – Markets unrattled by US inflation jump, dollar slips, stocks hit record

- Bond markets shrug off surge in US inflation as yields fall, dragging dollar to 3½-week low

- But stocks impervious as Tesla drives S&P 500 to fresh record; bank earnings coming up

- Dollar plunge lifts rivals, yen finds little love despite J&J vaccine woes

No panic after US inflation shoots higher

No panic after US inflation shoots higherMarkets appeared to brush aside fears of higher inflation after the much-anticipated CPI data out of the United States failed to spark a huge reaction on Tuesday. The US consumer price index rose to a 2½-year high of 2.6% y/y in March, mainly on the back of a jump in gasoline prices. However, Treasury yields went in the opposite direction, suggesting traders have mostly priced in the stronger inflation outlook for the next few months.

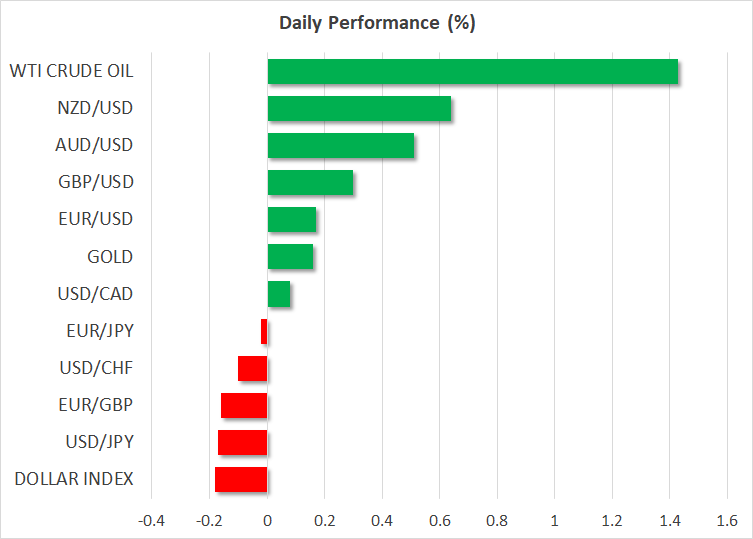

The 10-year yield fell almost nine basis points, pulling the dollar index down to a near 4-week low today.

Fed policymakers have been messaging for some time now that inflation will overshoot their 2% target due to transitory factors and the low base effect from when prices plummeted during the Spring 2020 global lockdowns. All the indications are that the Fed has succeeded in convincing markets that this inflationary outburst will be temporary, posing little threat to the rates outlook.

However, it’s too soon to be certain just yet that inflation will not overshoot by too much and fall back before the end of the year. The month-on-month increase in the CPI was a whopping 0.6% - the biggest monthly gain since August 2012. Business surveys around the world continue to point to higher input costs and with the pent-up demand expected to boost consumption as virus curbs are gradually lifted in the coming months, the ingredients are certainly there for an era of high inflation.

S&P 500 hits another record; tech back in favour?But as the dollar slid, stocks cheered the data on relief that the inflation spike was more or less in line with expectations. The S&P 500 climbed to fresh record territory, closing at a new all-time high of 4,141.59. Interestingly though, the benchmark index was led higher by gains in the Nasdaq than the Dow Jones, which had been the case more recently. The DJIA closed slightly lower (-0.20%), while the Nasdaq Composite added 1.05%.

The notable gainer among tech stocks was Tesla (+8.60%), which soared on forecasts that sales will skyrocket in the coming quarters as the electric car manufacturer ramps up its production capacity.

However, there was a broader trend at play as well. The US Food & Drug Administration paused the rollout of Johnson & Johnson’s Covid-19 vaccine on Tuesday as it investigates cases of blood clots. Although it is widely expected that inoculations with the Johnson & Johnson vaccine will resume soon, the troubling headlines have nevertheless raised some doubts about the reopening timeline of the US economy.

This may have had a dampening effect on value and cyclical shares yesterday and drawn some funds back into tech and growth stocks. Futures for all of Wall Street’s main indices were marginally up on Wednesday ahead of key earnings announcements from JP Morgan, Goldman Sachs and Wells Fargo before the market open.

Aussie and kiwi reenergised, Powell speech eyedIf defensive plays were a factor in boosting tech stocks, there was little sign of any risk-off moves in currency markets. The risk-sensitive antipodean pairs extended their gains today, with both the aussie and kiwi surging to three-week highs. There were no surprises from the Reserve Bank of New Zealand’s policy decision as the central bank kept its stimulus settings and guidance unchanged.

The pound also advanced against the greenback, rising above $1.38, though the euro lagged somewhat.

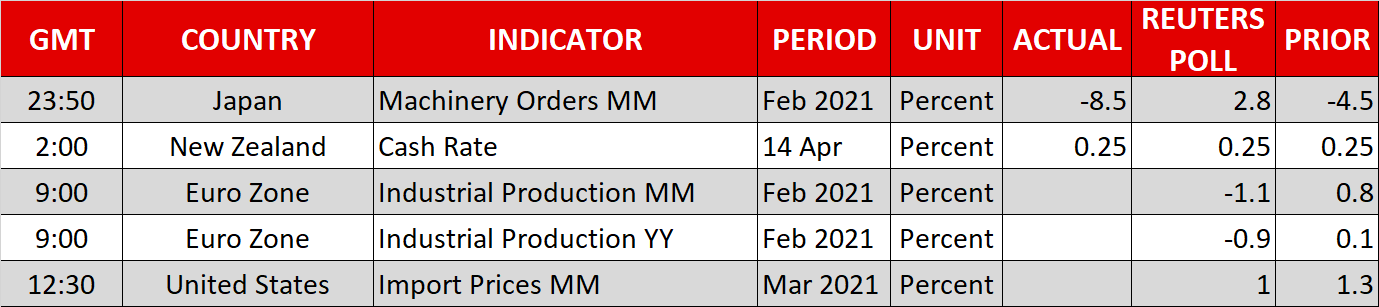

The safe-haven yen, meanwhile, declined against most of its major peers, unable to find much support from the fresh vaccine setbacks. An unexpected slump in Japanese machinery orders may be weighing on the currency as it casts doubt about the strength of Japan’s economic recovery.

The main highlight later today will be a speech by Fed Chair Powell at 17:00 GMT who is scheduled to speak at the Economic Club of Washington in a virtual event.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。