Daily Market Comment – Stocks steadier after crashing again; dollar also firmer

- Wall Street suffers biggest drop since 1987 crash as investors flee stocks

- Growing virus response still not enough to quell market turmoil

- Gold remains on a down path as panicky investors turn to cash

- Pound underperforms along with commodity and EM currencies

Bloodbath on Wall Street

Bloodbath on Wall StreetThere was no escaping the market carnage on Monday as extraordinary moves by the Federal Reserve and other central banks to restore investor confidence failed spectacularly. Shares on Wall Street plunged by the most since the stock market crash of 1987, with the Dow Jones sinking by 12.9% and the S&P 500 by 12.0%.

Shares in Europe were also a sea of red as the Euro Stoxx 50 index plummeted to the lowest since 2012.

Increasingly coordinated action by policymakers in recent days has had little effect in easing the market pain as the intense uncertainty about how this virus outbreak will unfold over the coming months and its effect on every part of the economy and society has left investors running for cover.

The Fed’s emergency 1% rate cut and injection of liquidity by all major central banks has been unable to allay deep concerns about the future of hard-hit industries such as airlines, travel and leisure. But with more and more governments telling their citizens to stay at home, other sectors could soon be joining airlines in requesting state bailouts.

Can US fiscal stimulus save the day?The French and New Zealand governments became the latest to announce fiscal measures to help their economies get through the crisis, while Australia and the UK signalled that more aid on top of already announced stimulus is on the way.

But what matters more for traders is whether the United States can deliver a sizeable fiscal stimulus that would ease fears of the American economy going into a steep recession. And the markets may have gotten the first hint of a bigger virus relief bill yesterday after Treasury Secretary Steven Mnuchin met with Senators to push for a broader package.

This may be helping sentiment today as shares in Asia pared losses, while European indices and US stock futures have turned positive. Although bargain hunting following the relentless selling is also likely contributing to the rebound.

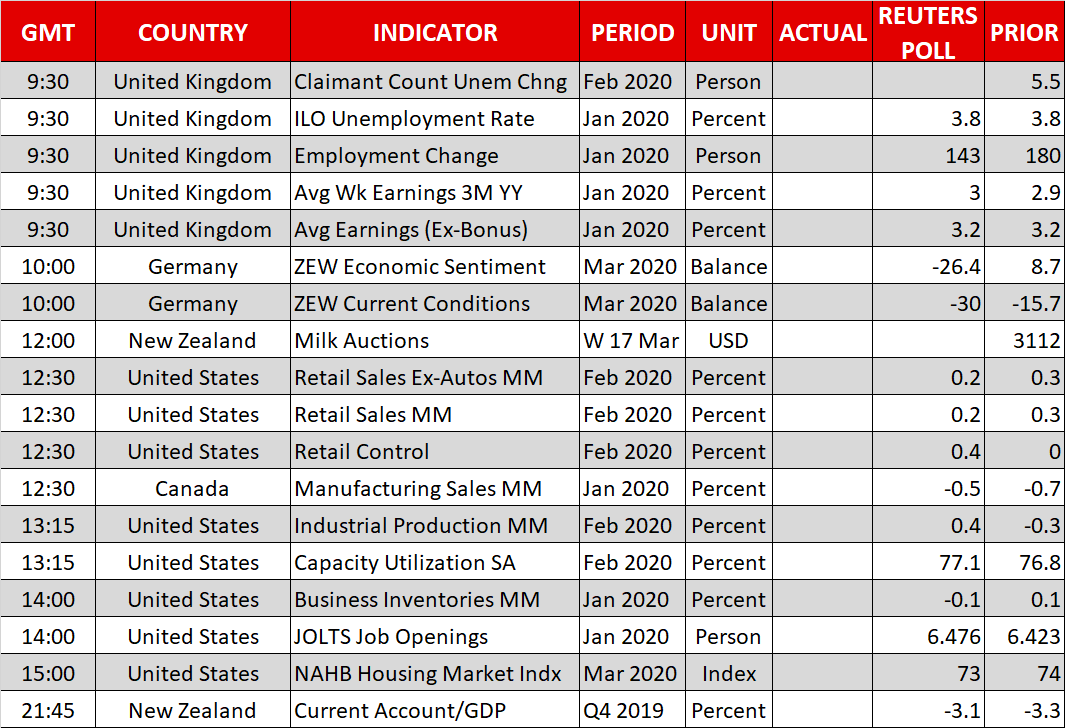

Dollar on firmer footing, gold slips againThe US dollar regained some poise on Tuesday after coming under pressure yesterday from the Fed’s surprise rate cut. The dollar index was last up 0.4%, helped by a broadly weaker yen, but the greenback also advanced against the euro and the Swiss franc. The rebound could extend if US retail sales numbers due later today beat expectations.

The slight lessening in safe haven demand weighed on gold, though the precious metal has been on the slide since the stock market sell-off accelerated a week ago. Investors have been dumping gold alongside risk assets to cover margin calls and as many traders increase their diversification into cash.

Gold was last trading at $1,483 an ounce in the spot market, down more than 12% from its 7-year peak set on March 9.

Pound slumps, commodity and EM rout continuesA slight pullback in the safe-haven yen provided some breathing space for the battered pound and the commodity-linked currencies like the Australian dollar but all still struggled against their US counterpart. Cable slumped to a more-than 6-month low of $1.2189, behaving more like an emerging market (EM) currency at times of a crisis given the UK’s large current account deficit.

In the EM sphere, the Mexican peso has been one of the worst performers, hitting an all-time low of 23 per dollar yesterday. Aside from the virus turmoil, the collapse in oil prices has not done the peso any favours, nor for the Australian, Canadian and New Zealand dollars, all of which are heavily exposed to commodity prices.

The aussie is in danger of soon breaching the $0.60 mark amid increasing speculation the Reserve Bank of Australia is preparing to launch a quantitative easing program.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。