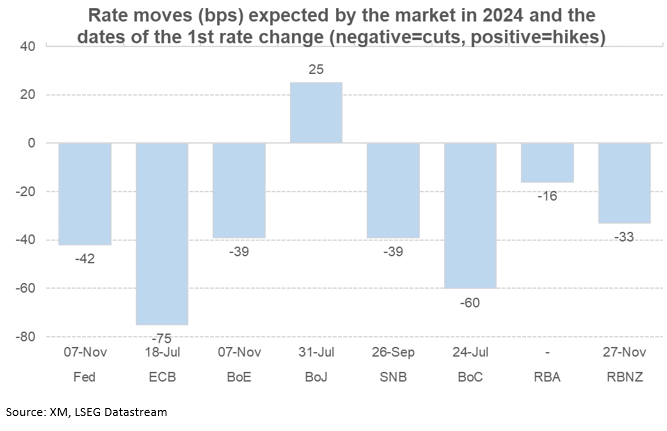

Market continues to price in a plethora of rate cuts for 2024

Market is still in monetary easing mode despite fewer rate cuts priced in across the board

Divergent cut expectations for the Fed and the ECB, reflecting economic conditions

The ECB and the BoC are seen cutting in July; the RBA might not cut rates this year

BoJ is seen hiking again during 2024

BoC: two rate cuts and room for moreThe Bank of Canada is probably the most dovish central bank at this juncture. The significant progress made in inflation was acknowledged in the most recent BoC gathering with Governor Macklem talking about the need for further evidence of a sustainable easing inflation. When examining the domestic issues, especially the housing sector, one could say that the two rate cuts currently priced in are probably an underrepresentation of current situation and hence more rate cuts could be announced in 2024.BoE, SNB, RBNZ: one rate cut and done for 2024?These three diverse central banks are probably going to announce at least one rate cut in 2024. The UK continues to experience high inflation and a relatively low growth rate. Bank of England members are preparing for the much-touted rate cuts, but the threat of renewed inflationary pressures, on the back of the latest geopolitical developments supporting the recent oil price rally, is keeping them up at night.The year started with the market expecting almost four rate cuts by the Reserve Bank of New Zealand in 2024. Similarly to other central banks, inflation is proving stickier even though recent data is pointing to a weakness in consumer spending. Somewhat surprisingly, the RBNZ maintained its hawkishness at the recent meeting and poured cold water of dovish expectations. The market expects only 33bps of easing in 2024.The Swiss National Bank surprised the market with its March rate cut. The low inflation forecasts for both 2025 and 2026 could mean that the SNB is not done yet. Hence, the market is currently fully pricing in another 25bps rate cut by September with around 56% chance of one additional move by year-end.RBA: could it keep rates unchanged for 2024?The Reserve Bank of Australia was the last one to hike in 2023 and the market is only assigning a 64% probability for a 25bps rate cut in 2024. Such a move though could become even more improbable if China finally manages to return to growth, influencing its main trading partners and the commodity markets.BoJ: the market wants moreThe first rate hike since 2007 has opened the market’s appetite for further rate moves, which matches Governor’s Ueda current thinking. The market is pricing in at least another two 10bps rate hikes in 2024 with the current yen weakness, and its impact on imported inflation, potentially offering the Bank of Japan an excuse to do even more down the line.

BoC: two rate cuts and room for moreThe Bank of Canada is probably the most dovish central bank at this juncture. The significant progress made in inflation was acknowledged in the most recent BoC gathering with Governor Macklem talking about the need for further evidence of a sustainable easing inflation. When examining the domestic issues, especially the housing sector, one could say that the two rate cuts currently priced in are probably an underrepresentation of current situation and hence more rate cuts could be announced in 2024.BoE, SNB, RBNZ: one rate cut and done for 2024?These three diverse central banks are probably going to announce at least one rate cut in 2024. The UK continues to experience high inflation and a relatively low growth rate. Bank of England members are preparing for the much-touted rate cuts, but the threat of renewed inflationary pressures, on the back of the latest geopolitical developments supporting the recent oil price rally, is keeping them up at night.The year started with the market expecting almost four rate cuts by the Reserve Bank of New Zealand in 2024. Similarly to other central banks, inflation is proving stickier even though recent data is pointing to a weakness in consumer spending. Somewhat surprisingly, the RBNZ maintained its hawkishness at the recent meeting and poured cold water of dovish expectations. The market expects only 33bps of easing in 2024.The Swiss National Bank surprised the market with its March rate cut. The low inflation forecasts for both 2025 and 2026 could mean that the SNB is not done yet. Hence, the market is currently fully pricing in another 25bps rate cut by September with around 56% chance of one additional move by year-end.RBA: could it keep rates unchanged for 2024?The Reserve Bank of Australia was the last one to hike in 2023 and the market is only assigning a 64% probability for a 25bps rate cut in 2024. Such a move though could become even more improbable if China finally manages to return to growth, influencing its main trading partners and the commodity markets.BoJ: the market wants moreThe first rate hike since 2007 has opened the market’s appetite for further rate moves, which matches Governor’s Ueda current thinking. The market is pricing in at least another two 10bps rate hikes in 2024 with the current yen weakness, and its impact on imported inflation, potentially offering the Bank of Japan an excuse to do even more down the line.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。