Tech stocks wobble on rising yields and chip demand worries ahead of Fed decision – Stock Markets

Stocks slide as Treasury yields advance ahead of FOMC rate decision

Worries over chip demand outlook casts shadows over AI growth prospects

Instacart validates tech IPO resurgence, but can the excitement last?

Undoubtedly, the main event of the week is the FOMC interest rate decision later on Wednesday, which will be accompanied by the updated dot plot and a summary of the latest economic projections. Markets are convinced that the Fed will hold rates steady, so all eyes will fall on FOMC members’ anticipation of the future interest rate trajectory as inflation fears have returned.

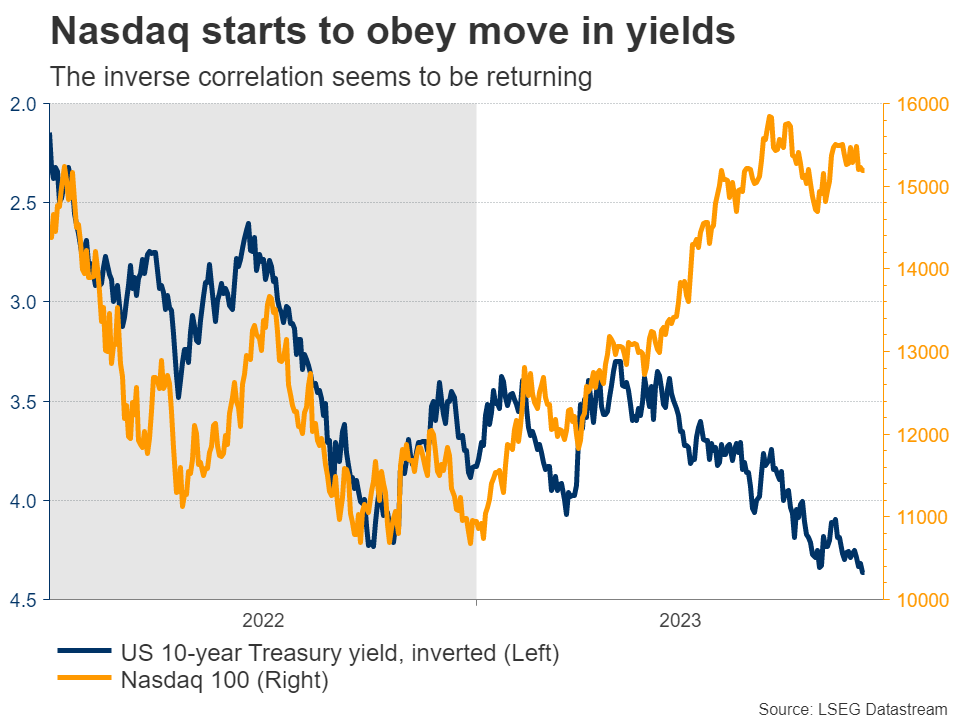

More precisely, by combining the updated economic forecasts and the new dot plot, investors could assess whether the Fed will hike one more time at the November meeting and if interest rates should remain higher for longer to tame a secondary inflationary wave. Lately, surging energy prices and the US auto union strikes have been underscoring the case of inflation getting stickier, which has in turn propelled Treasury yields at their highest levels since 2007 in the anticipation of a more aggressive Fed.

Generally, when yields move higher, risky assets such as stocks become less attractive than bonds from a risk-return perspective. Besides that, high interest rates also infuse upside pressure on the US dollar, which is a devastating development for the Nasdaq 100 that generates 60% of its revenue overseas. Finally, growth stocks seem to be in the most vulnerable position as their value relies heavily on the discounted future cash flows.

Softening chip demand could weaken the AI narrativeApart from the deteriorating macro backdrop, some news regarding slowing chip demand acted as an additional headwind for the tech sector. The leading chipmaker TSMC is said to have urged its suppliers to delay the delivery of some advanced chipmaking materials due to concerns over fading demand. On a similar note, Intel’s shares fell more than 4% after the management cited that chip demand from data centres has been soft, leading to excess inventories.

Overall, the lower-than-expected demand for chips is ringing some bells to the AI enthusiasts, hinting that markets might have overpriced the prevailing trend’s growth potential. However, it is still too early to draw conclusions as the trade war between the US and China could easily flip things around and even create a chip shortage in the future.

Tech IPOs stage a solid comeback, but traders should remain cautiousAfter a prolonged period of IPO drought, it seems that tech startups are trying to capitalise on the AI mania and boost their valuations. For instance, UK chip designer, Arm, went public last week, with its deal being six times oversubscribed and the stock price jumping 25% above the target price. However, all these gains evaporated in less than a week, suggesting that investors were only focused on its AI status and neglected the vast premium.

Similarly, a grocery delivery group, Instacart, had gained more than 40% in its Wall Street debut before closing only 10% above its offering price. The aforementioned examples underscore investors’ renewed appetite for tech startup listings, but for now it seems that the AI mania is tempting them to accept excess premiums or overoptimistic growth projections.

Nasdaq drops below 50-day SMAFrom a technical standpoint, the Nasdaq 100 fell below its 50-day simple moving average (SMA), which had acted as strong support in the past week. Can the Fed inflict more damage? To the downside, further declines could cease at the July support of 14,924 ahead of the August bottom of 14,557.

To the downside, further declines could cease at the July support of 14,924 ahead of the August bottom of 14,557.

Alternatively, a dovish surprise may shift attention to the September high of 15,618 before the bulls attack the 2023 peak of 15,932.

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。