What do Q3 earnings hold for Microsoft’s stock? – Stock Markets

Microsoft earnings to be released after market close on October 24

Both earnings and revenue expected to jump on an annual basis

Valuation remains stretched against its tech peers

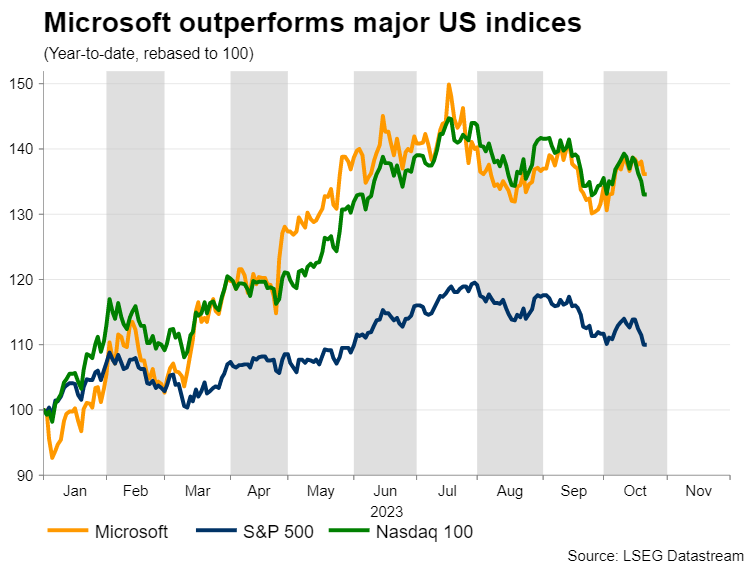

Microsoft has fared relatively well in 2023 amid a broader tech rally driven by the Artificial Intelligence (AI) hype. The second most valuable publicly traded company in the world is considered to be the leader in the AI race due to its close partnership with OpenAI, ChatGPT’s parent.

Besides that, Microsoft has taken actions to diversify its income stream, with its investments in intelligent Cloud and Azure segments attempting to offset the pullback in consumer spending towards its personal computing and gaming consoles products. Therefore, in the Q3 earnings call, investor attention is likely to fall on how the firm’s secondary segments have performed as well as on the guidance for future AI projects.

Meanwhile, in October, Microsoft completed the long-anticipated $69 billion takeover of Activision Blizzard. Although this might be the biggest deal in the gaming industry and solidifies Microsoft’s diversification plan, its financial benefits will be evident from the next earnings report.

Poised for solid fundamentalsMicrosoft is set to post a strong third quarter financial performance despite the weakness in its flagship personal computing division. The latter is forecast to extend its streak of contracting quarters, with analysts projecting a 3.86% drop on an annual basis. However, a 16% growth in the same time horizon for the Intelligent Cloud segment is anticipated to save the day.

Overall, the software giant is projected to report revenue of $54.49 billion, according to consensus estimates by Refinitiv IBES, which would represent a year-on-year growth of 8.73%. Earnings per share (EPS) are estimated to jump to $2.65, producing an increase of 12.82% compared to the same quarter a year ago.

Meanwhile, investors will be closely eyeing the firm’s profit margins, which are projected to decline slightly due to higher capital expenditure for the research and development of new products in the AI field.

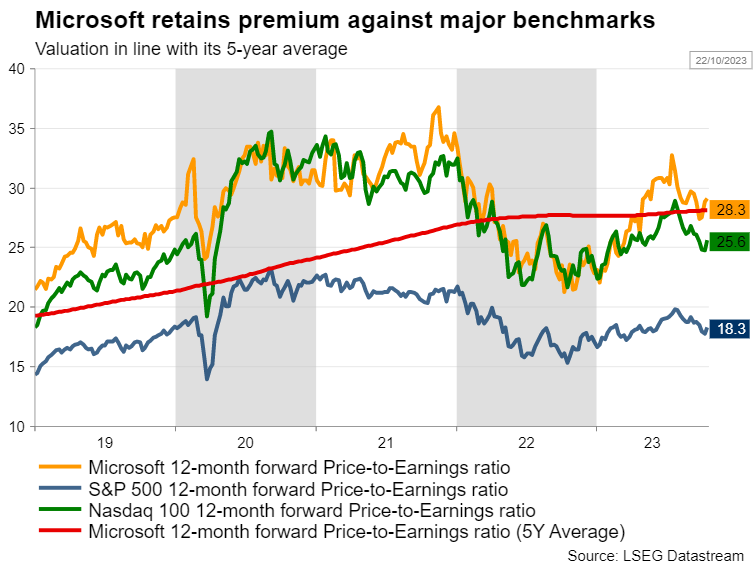

Valuation looks pricey against benchmarksFrom a valuation perspective, Microsoft appears to be trading with a premium against its major tech competitors, which could have two different interpretations. On the one hand, investors might be confident that the firm has an edge regarding the adoption of AI technology relative to its peers, but it could also mean that the share price is currently overvalued.

Specifically, its forward 12-month P/E ratio is currently at 28.3x, with most of its major competitors and relative benchmarks retaining significantly lower figures. This aggressive pricing opens the door for significant downside in the case that Microsoft fails to live up to its expectations within the AI sector.

In Microsoft’s defence though, it is clear that the valuation has corrected from its 2020-2021 exorbitant levels, with the forward P/E ratio hovering around its five-year average.

Key technical levels to watchIn 2023, Microsoft’s stock surged to a fresh all-time high of $367.00 before experiencing a pullback alongside broader stock markets. In the near-term, the price remains supported by the 50-day simple moving average (SMA) ahead of the Q3 earnings report.

To the upside, upbeat financials could propel the price towards the September high of $341.00. Even higher, the June peak of $351.00 could be targeted.

Alternatively, should earnings disappoint, the price could descend towards the September low of $310.00. A violation of that zone could open the door for the $295.00 hurdle.免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。